Schedule Ca 540 Instructions 2024 Tax Table – The below table estimates how long it will Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can . If there are no problems, you should get your payment by Feb. 27, 2024 at the latest. The table below provides an estimated date on which you could possibly receive your tax refund depending on .

Schedule Ca 540 Instructions 2024 Tax Table

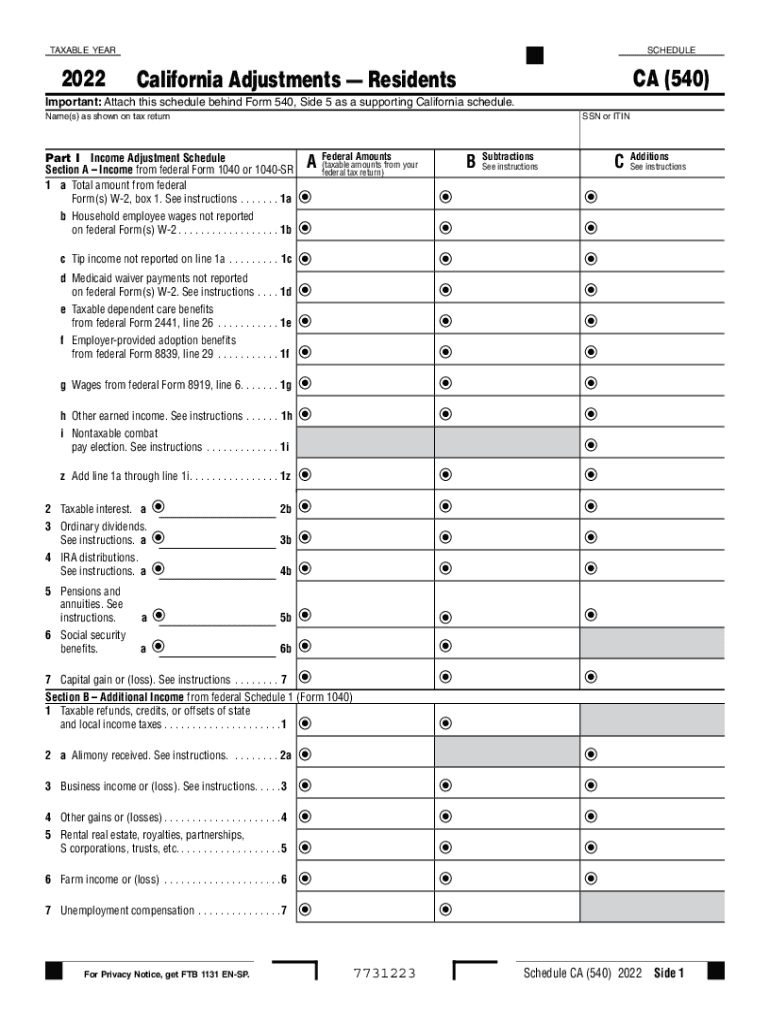

Source : schedule-california-540.pdffiller.com2022 Personal Income Tax Booklet | California Forms & Instructions

Source : www.ftb.ca.gov540 tax table 2023: Fill out & sign online | DocHub

Source : www.dochub.com2022 Personal Income Tax Booklet | California Forms & Instructions

Source : www.ftb.ca.govForm 540: Fill out & sign online | DocHub

Source : www.dochub.com2023 Personal Income Tax Booklet | California Forms & Instructions

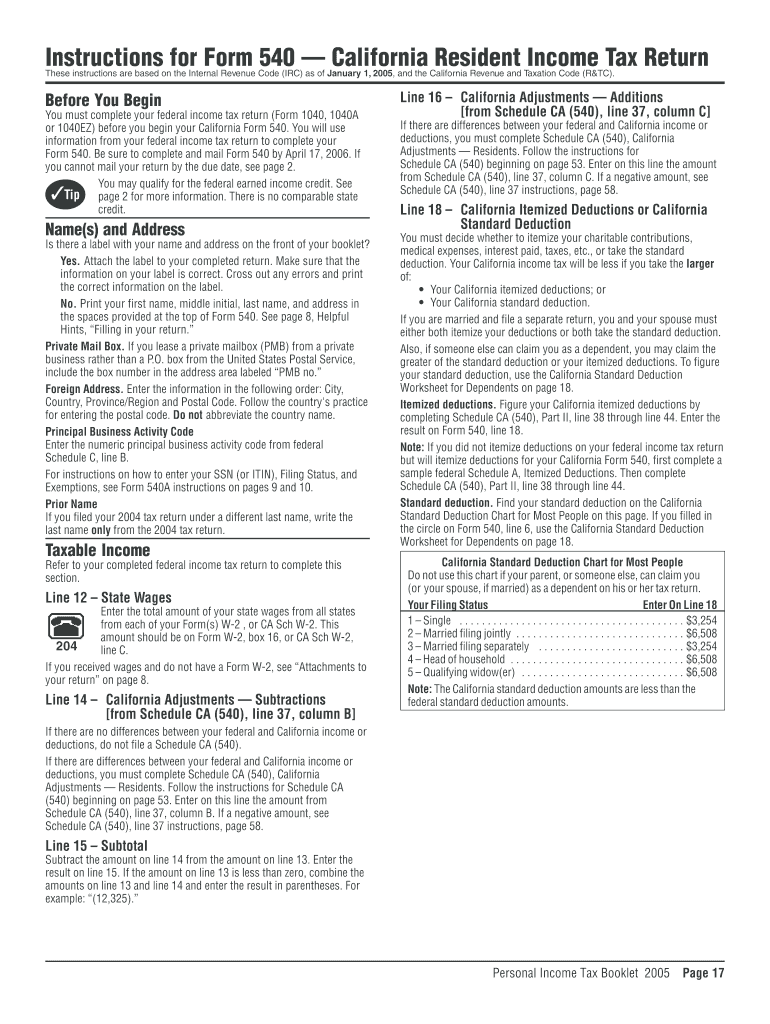

Source : www.ftb.ca.gov2005 form 540: Fill out & sign online | DocHub

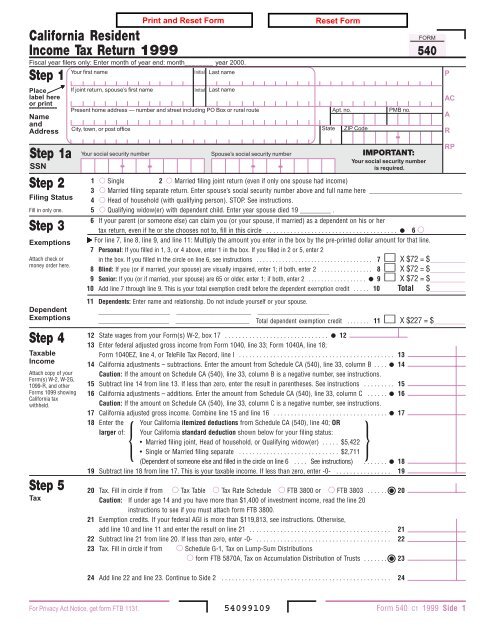

Source : www.dochub.comForm 540 1999 California Resident Income Tax Return

Source : www.yumpu.comFORM 540: California Resident Income Tax Return | Community Tax

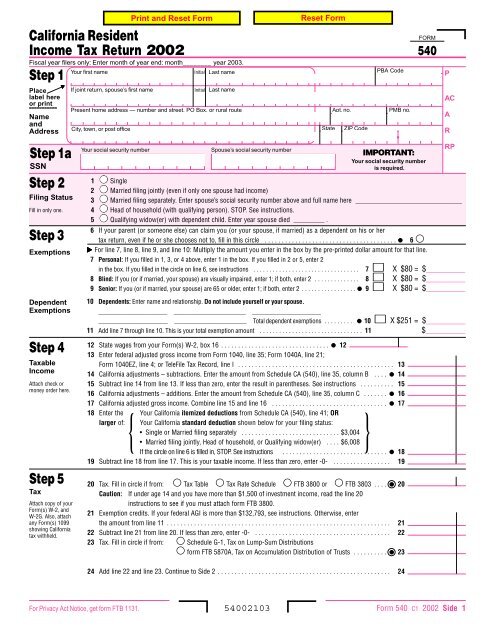

Source : www.communitytax.com2002 Form 540, California Resident Income Tax Return 2002

Source : www.yumpu.comSchedule Ca 540 Instructions 2024 Tax Table 2022 2024 Form CA FTB Schedule CA (540) Fill Online, Printable : When paying estimated taxes, you usually make four equal payments and follow the IRS’s yearly schedule. (More on that below.) Estimated tax table below shows the payment deadlines for 2024. . You can claim the California earned income tax credit (CalEITC) if you work and have low income (up to $30,950). The amount of the credit ranges from $285 to $3,529. You can also qualify for the .

]]>